Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial statement of debtor?

A financial statement of a debtor is a document that provides a summary of the financial position of an individual or entity who owes money or is liable for debt. It typically includes the following components:

1. Balance sheet: This presents the debtor's assets, liabilities, and equity at a specific point in time. It indicates what the debtor owns (assets), what they owe (liabilities), and the net worth of the debtor (equity).

2. Income statement: Also known as a profit and loss statement, it shows the debtor's revenues, expenses, and net income or loss over a specific period. The income statement reflects the debtor's ability to generate income and manage expenses.

3. Cash flow statement: This outlines the inflows and outflows of cash within a specified period. It highlights the sources and uses of cash, providing insight into how the debtor manages their liquidity.

These financial statements are essential for assessing the debtor's financial health, creditworthiness, and ability to repay debts. Banks, creditors, investors, and other financial stakeholders often request these statements to evaluate the risk associated with lending money or extending credit to the debtor.

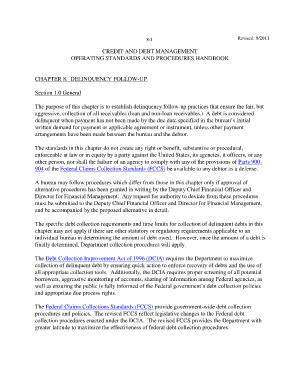

Who is required to file financial statement of debtor?

The financial statement of a debtor is typically required to be filed by the debtor themselves, usually in the context of a bankruptcy proceeding. This helps provide a comprehensive overview of the debtor's financial situation, including assets, liabilities, income, and expenses. The filing of these statements allows creditors, the court, and other relevant parties to assess the debtor's financial status and determine the most appropriate course of action in relation to the debts owed.

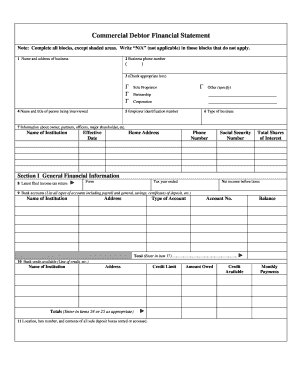

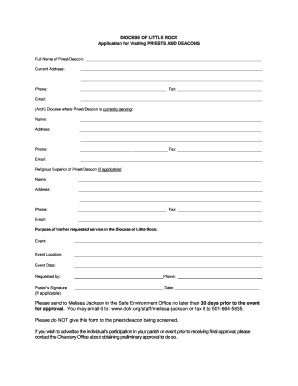

How to fill out financial statement of debtor?

To fill out a financial statement of a debtor, follow these steps:

1. Gather the necessary information: Collect all required financial documents, such as bank statements, pay stubs, tax returns, loan statements, credit card bills, and any other relevant financial records.

2. Enter personal information: Begin by filling out the debtor's personal details, including their full name, address, phone number, and social security number.

3. Complete income section: List all sources of income, such as employment salary, self-employment income, rental payments, pension, social security benefits, etc. Provide supporting documentation, including pay stubs or income tax returns, to verify the income stated.

4. Detail living expenses: Itemize and calculate the monthly living expenses, including rent/mortgage payments, utilities, groceries, transportation costs, insurance (health, car, etc.), childcare expenses, and other regular expenditures. Attach supporting receipts or bills to substantiate the claimed expenses.

5. List assets: Enumerate all assets owned by the debtor, such as real estate properties, vehicles, bank accounts, investments, retirement accounts, valuable personal belongings, etc. Include the estimated value of each asset.

6. Declare liabilities: Disclose all outstanding debts, loans, credit card balances, student loans, mortgages, and any other liabilities. Include the name of the creditor, outstanding balance, monthly payment, and the nature of the debt.

7. Provide additional financial information: The financial statement might require additional information, such as the debtor's employment history, educational background, dependent children, and any legal obligations or pending legal actions.

8. Calculate net worth: Deduct the total liabilities from the total assets to determine the debtor's net worth.

9. Review and sign: Carefully review the completed financial statement, verifying that all the provided information is accurate and complete. Sign and date the document to confirm its authenticity.

Keep in mind that the financial statement of a debtor may have different formats or specific requirements depending on the jurisdiction or legal context. If you're unsure about any particular sections or obligations, consult with an attorney or a financial professional for guidance.

What is the purpose of financial statement of debtor?

The purpose of a financial statement of a debtor is to provide a snapshot of the financial health and performance of the debtor. It helps creditors, investors, and other stakeholders to assess the creditworthiness, solvency, and overall financial stability of the debtor. The financial statement provides information about the debtor's assets, liabilities, expenses, revenue, and financial ratios, allowing stakeholders to make informed decisions regarding lending, investing, or doing business with the debtor. Additionally, the financial statement allows debtors to analyze their own financial position, identify areas of strength and weakness, and develop strategies for improvement.

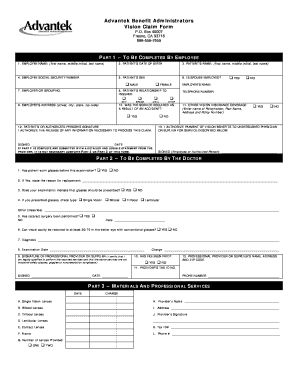

What information must be reported on financial statement of debtor?

The financial statement of a debtor typically includes the following information:

1. Balance Sheet: This provides a snapshot of the debtor's financial position at a specific point in time, generally including assets (such as cash, accounts receivable, inventory, and property), liabilities (such as accounts payable, loans, and debt), and equity (such as shareholders' equity or owner's equity).

2. Income Statement: This shows the debtor's revenue, expenses, and net income (or loss) over a specific period, indicating the profitability of the business.

3. Statement of Cash Flows: This outlines the inflows and outflows of cash into and out of the debtor's business during a specific period, detailing the sources and uses of cash.

4. Notes to Financial Statements: These provide additional explanatory information about specific items on the financial statements, significant accounting policies used by the debtor, and any contingencies or commitments.

5. Statement of Changes in Equity: This summarizes the changes in equity during a specific period, showing the beginning and ending balances of equity and detailing any direct or indirect contributions or distributions made to or by the debtor.

Further information, such as a schedule of accounts receivable and accounts payable, can also be reported as part of the financial statement to provide more detailed information about the debtor's financial activities. It is important to note that the specific reporting requirements may vary depending on the applicable accounting standards and regulations in different jurisdictions.

What is the penalty for the late filing of financial statement of debtor?

The penalty for the late filing of financial statements by a debtor can vary depending on the jurisdiction and specific circumstances. In general, late filing penalties can include fines, interest, late fees, and potential legal consequences. These penalties aim to encourage timely and accurate reporting, ensuring transparency and accountability in financial matters. It is advisable to consult the relevant laws and regulations pertaining to a specific jurisdiction to determine the exact penalties and consequences for late filing of financial statements.

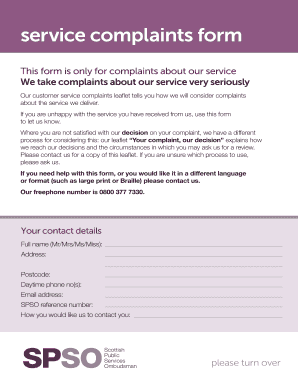

Can I create an electronic signature for the financial statement of debtor form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your financial statement of debtor pdf form in seconds.

How do I fill out the financial statement of debtor form on my smartphone?

Use the pdfFiller mobile app to complete and sign debtor statement investing on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete doj financial statement of debtor on an Android device?

Use the pdfFiller mobile app to complete your financial statement debtor form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.